Send us a message to explain your needs. A tax representative will get back to you quickly.

Registration and secure space

- obtain an identification number France (SIREN),

- open a personal on-line file

- with or without tax representation

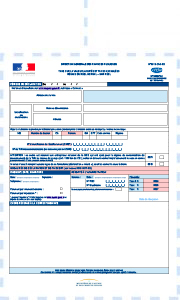

VAT

- request a VAT ID number on your behalf

- fill out and file your tax returns electronically

- and deal with the online payment of your taxes

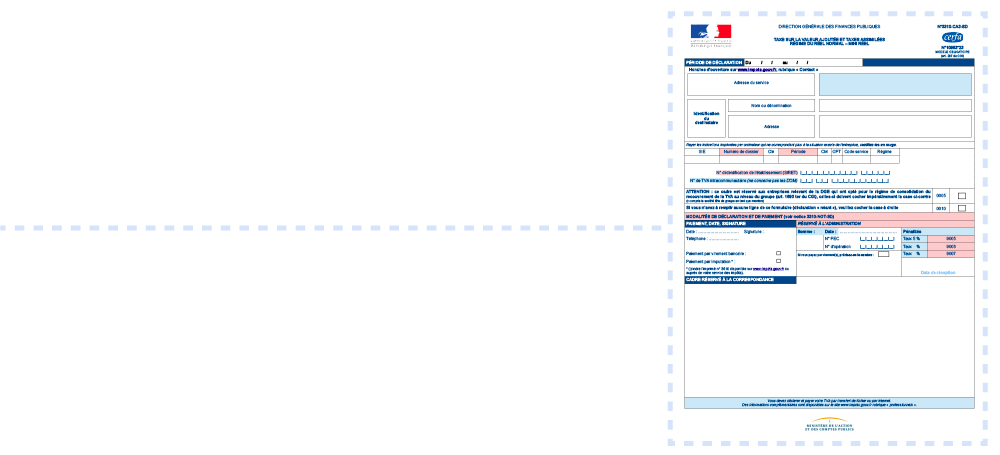

3 percent annual tax

Subject to the specific exemptions, a 3 percent tax on the commercial value of immovable property owned in France by a foreign legal entity is provided for in Articles 990D, 990E, 990F, 990G of the General Tax Code. Whether you benefit from an exemption or you are liable for the tax, Gestion & Services can act as your representative under Article 223 quinquies A of the General Tax Code and fill out the required tax forms while making sure the filing deadlines are met.

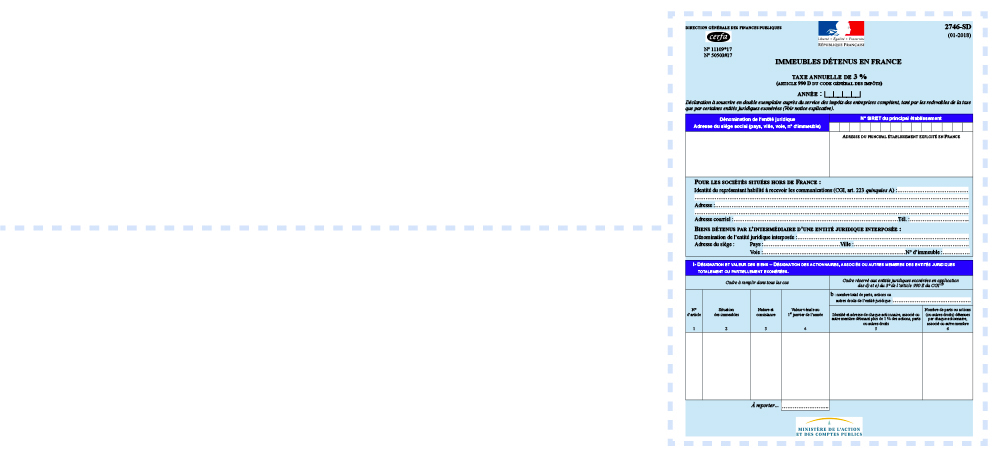

Corporate Income Tax

Subject to the applicable international conventions, companies headquartered abroad are taxable on their profits resulting from their operations in France. Gestion & Services can monitor the deadlines and handle the administrative procedures on your behalf with the help of the accountant in charge of balance sheets.

Administrative stand-in

Gestion & Services can help you fulfill your administrative requirements in France.

As such, we personally handle your administrative duties, such as mail management, bank account monitoring, bill payments, communication with asset managers, document filing with public authorities or private companies, dealings with public officers, etc.

Our knowledge of French administrative intricacies together with our thoroughness allow us to provide you with the best possible service.