Send us a message to explain your needs. A tax representative will get back to you quickly.

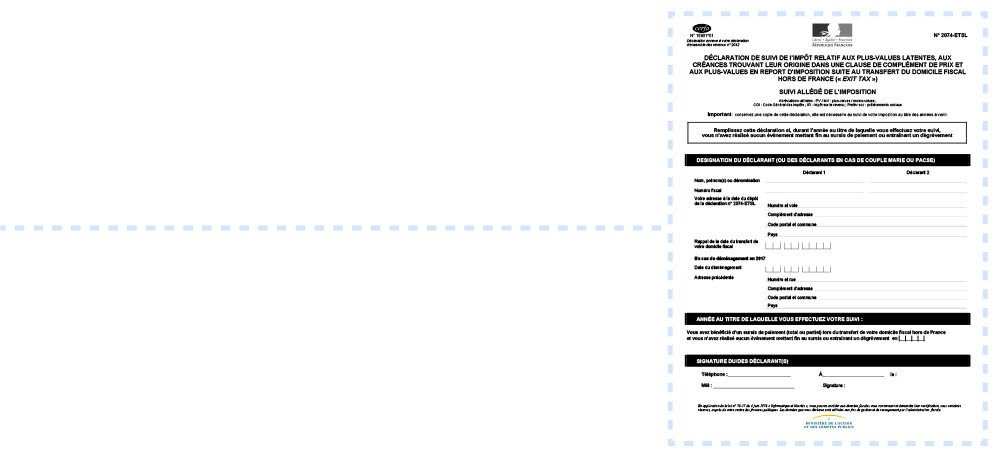

EXIT TAX

If you transfer you tax residence abroad during the course of the year, you could be subject to income tax and social security contributions (prélèvements sociaux), particularly in respect of unrealized gains. In some cases provided for in Article 167bis of the General Tax Code, you can be granted a deferred payment upon specific request, in which case you are required to appoint a tax representative.

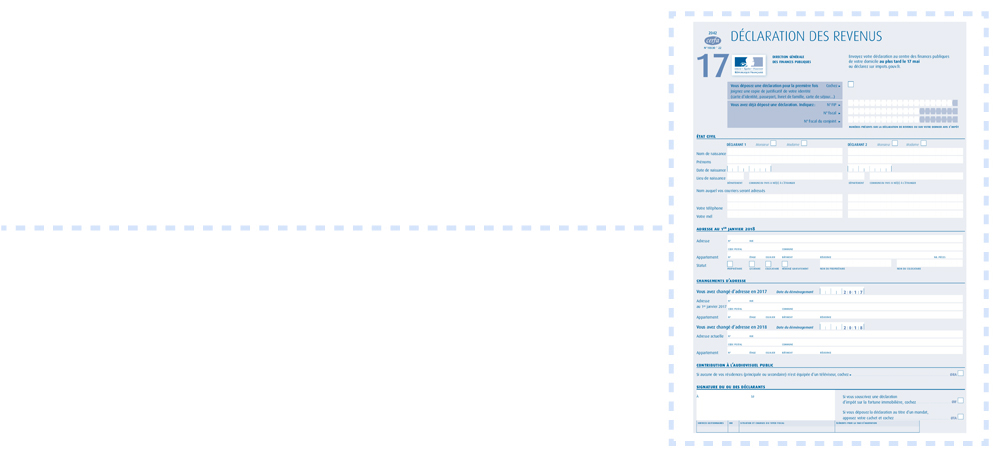

Income Tax and/or Real Estate Wealth Tax

If you own real estate in France, the French Tax Department may require you to appoint a tax representative (under Article 164D of the General Tax Code), whether it is occupied by you or your family or whether you lease it out on a seasonal or permanent basis.

Other taxes

You can rely on Gestion & Services to monitor your tax deadlines and file your tax returns (Property Tax, Occupant Tax, etc.). We can also deal with other authorities, institutions and providers on your behalf.

Administrative stand-in

Gestion & Services can help you fulfill your administrative requirements in France.

As such, we personally handle your administrative duties, such as mail management, bank account monitoring, bill payments, communication with asset managers, document filing with public authorities or private companies, dealings with public officers, etc.

Our knowledge of French administrative intricacies together with our thoroughness allow us to provide you with the best possible service.